Unlocking Vietnam’s sustainable bond market: Overcoming barriers and empowering corporate leaders to drive green finance

27 January 2025 — Sustainable bond market is essential to mobilize financing flows, but its potential remains untapped in Vietnam. This article explores the key challenges and highlights how corporates can leverage green finance to position themselves at the forefront of Vietnam’s sustainable transformation.

Problem

Sustainable bonds have emerged in Vietnam as a vital tool to leverage financial markets and drive the efforts to meet the nation’s long-term development goals. While Vietnam has made progress with green and sustainability bonds in recent years, its market remains small compared to regional peers, requiring greater effort.

Why it happens?

The sluggish growth of Vietnam’s sustainable bond market stems from underdeveloped bank-centric financial market, weak regulatory frameworks, the absence of a standardized green taxonomy, and limited incentives for corporate issuers. High issuance costs, a lack of technical expertise, and low public awareness further hinder its development.

Solution

Corporate executives can drive Vietnam’s sustainable bond market by developing clear sustainability strategies, collaborating with banks, and building internal capacity. Strengthening expertise, ensuring transparent reporting, and exploring innovative financing models will enhance credibility, unlock new opportunities, and boost competitiveness amidst Vietnam’s transition to a sustainable economy.

Download this post (PDF)

Vietnam’s sustainable bond market is essential for addressing the country’s financing gap, but it remains underdeveloped compared to regional peers

Sustainable bonds are vital for mobilizing capital towards environmentally and socially responsible projects. As Vietnam ranks sixth among countries most vulnerable to climate change, securing adequate financing is crucial to meet Nationally Determined Contributions (NDCs) under the Paris Agreement. The German Agency for International Cooperation (GIZ) estimates Vietnam will need 21.2BUSD by 2030 to fund sustainability projects[10], reinforcing the urgent need to scale green financing. Yet, Vietnam sustainable bond market tells a different story—a tale of untapped potential and slow progress. Between 2021 and 2023, Vietnam issued a mere 0.8BUSD in sustainable bonds, including just 0.1BUSD in green bonds in 2023, far behind its global and regional peers[1].

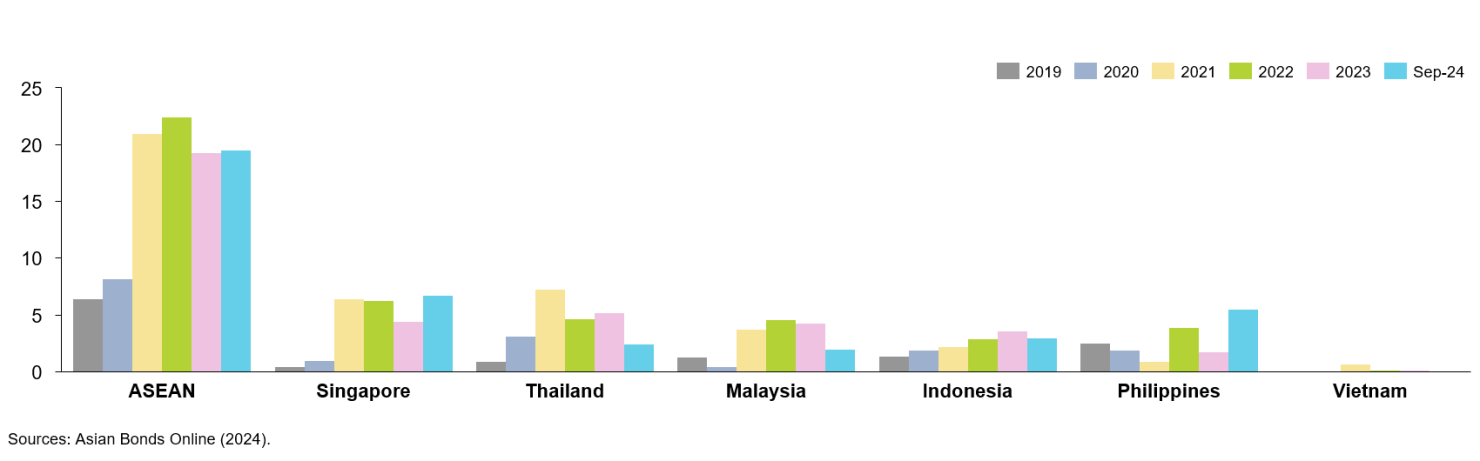

Globally, sustainable debt markets have grown exponentially, reaching a cumulative issuance of 4.4TUSD by the end of 2023[2]. Green bonds, in particular, have become essential tools for addressing climate change, with cumulative issuances totaling 2.8TUSD by 2023[2]. China dominates Asia’s green bond market, having issued 83.5BUSD in 2023 alone, due to harmonized taxonomies and strong state-driven initiatives[2]. Meanwhile, ASEAN member states such as Singapore and the Philippines are rapidly expanding their green bond markets, propelled by innovative policies and private sector participation, highlighted in figure 1. The Philippines demonstrated remarkable growth, with issuance surging to 5.5BUSD, supported by government-led efforts and increased corporate engagement[2]. Singapore also saw a strong recovery, reaching 6.7BUSD by September 2024, solidifying its leadership position[2]. This market recovery reflects improved investor sentiment and regional policy support.

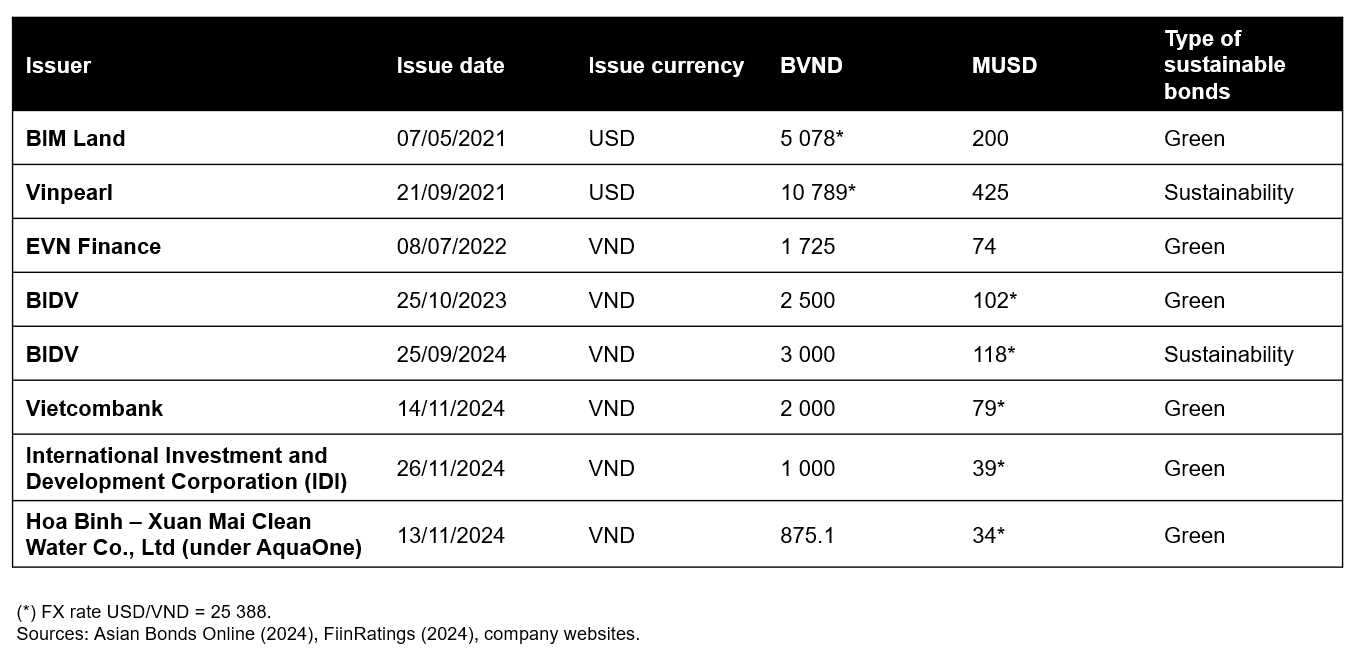

While Vietnam’s sustainable bond market remains in its early stages, recent developments signal progress. As shown in figure 2, four new issuances from both bank and non-bank entities amounted to 3875BVND (153MUSD) in November 2024. [1], [4] Notably, listed in figure 3, non-bank issuers, such as IDI (1000BVND) and Hoa Binh-Xuan Mai (875BVND) demonstrated the increasing role of corporations in driving green finance[8], [9]. The issuance of IDI is also the first-ever aquaculture corporate green bond in Asia. These issuances set a precedent for other businesses, highlighting opportunities for corporate executives to tap into sustainable financing and align their operations with national development goals.

Currently, proceeds from sustainable bonds in Vietnam are primarily directed toward green initiatives, reflecting the country’s ambitious push to expand renewable energy capacity. Prominently, 7 out of 8 issuances include renewable energy as an eligible project category, while pollution prevention, sustainable transport, and sustainable water management are featured in 5 out of 8 issuances. Social bond categories, however, remain limited, appearing only in two sustainability issuances from Vinpearl and BIDV, covering affordable housing and access to essential services. As such, this article focuses predominantly on green bonds. Nonetheless, corporate executives are encouraged to consider other types of bonds to finance a wider range of projects and expand their impact across various fields.

The next three chapters of this article will cover the following: first, an overview of governmental policies to guide corporate leaders in navigating the market; second, a detailed examination of key barriers that need to be addressed; and third, practical implications and strategies for corporate executives to thrive and gain a competitive advantage.

Government policies and initiatives are beginning to support sustainable bond development, but progress is still in its early stages

Vietnam has been implementing policies and initiatives to promote green bonds, though much of the progress is still in its infancy. Recent legislation and international partnerships have set the stage for future growth. The Environmental Protection Law No. 72/2020/QH14, enacted in 2020 by the National Assembly, serves as a foundational legislative framework for environmental activities. Article 150 of this law outlines the rights and obligations of local authorities and enterprises seeking to raise capital for environmental protection initiatives and investment projects with environmental benefits[13]. Not only that, in 2022, the National Assembly introduced Resolution 29-NQ/TW, aiming to advance industrialization and modernization by 2030 and 2045[15]. This resolution emphasizes sustainable development goals, including renewable energy, the green economy, and green financing, with seven out of ten directive terms dedicated to these objectives. Subsequently, several instructive decrees were issued to further bolster the efforts toward building a more sustainable economy. For example, Decree 83/2023/NĐ-CP was published in 2023 to address initial barriers to funding the green economy, circular economy, and emission reduction projects[14].

Among these discussions, green bonds have been recognized as an integral part of Vietnam's efforts to mobilize sustainable financing and drive environmentally focused investments. They were mentioned as early as 2018 through Decree 163/2018/NĐ-CP and later detailed in Decree 153/2020/NĐ-CP, which outlined regulations for corporate bond issuance. In 2021, the State Securities Commission (SSC) collaborated with international organizations to launch the handbook titled "Guidelines on Green Bonds, Social Bonds, and Sustainable Bonds"[16].

International cooperation has also played a major role. Vietnam has collaborated with the German Corporation for International Cooperation (GIZ) since 1993, initially focusing on economic reform[12]. Over the years, the partnership has expanded to include various sectors such as climate change, energy transition, and green economy. In the collaboration with GIZ, Vietnam has launched the Shifting Investment Flows Towards Green Transformation (SHIFT) Project in 2023[17]. This project aimed to improve conditions for financing investments in climate protection and green energy transition in Vietnam. It focuses on developing favorable policy frameworks, building capacities of relevant actors, and promoting green financing by banks.

Additionally, in July 2023, the Ministry of Finance and the French Development Agency (AFD) signed a cooperation framework on green finance policy[18]. This collaboration underscores the government’s efforts to strengthen green finance policies, including green tax policies, legal frameworks, and capacity building for issuing green government bonds. Following this agreement, the Ministry of Finance proposed tax benefits for green bond issuers and buyers in September 2023[19], although this proposal has yet to be enacted into law as of December 2024.

While these initial efforts mark significant progress, much more remains. With Vietnam’s sustainable bond market achieving an important milestone in Q4 2024, addressing the barriers to its growth is of increasing importance. The next chapter will explore the key challenges hindering its development.

Tackling barriers is crucial to unlocking the growth and full potential of Vietnam’s sustainable bond market

Vietnam should strengthen its legal and regulatory framework by developing a unified green taxonomy, enhancing oversight mechanisms, and adopting international best practices to build investor confidence and mitigate greenwashing risks. Additionally, fostering green bond market growth requires financial incentives, technical capacity building, and public awareness campaigns to reduce entry barriers, improve verification standards, and increase stakeholder participation in green bond initiatives. In this chapter, we will propose solutions to address main challenges in the market development:

- Strengthen regulations and creating a unified framework: Even though the handbook “How-to Issue Guide for Green Bonds, Social Bonds and Sustainability Bonds” by the State Securities Commission of Vietnam[3] has provided Vietnamese market participants with the knowledge of how to issue green, social and sustainability bonds based on the best available international practices, there is still the absence of a unified green taxonomy, limiting investor confidence and increasing the risk of greenwashing. Currently, Vietnam has yet to develop a national green taxonomy, but following the World Bank’s "Developing a National Green Taxonomy" guide could provide a clear pathway for building a structured and sustainable financial system. This taxonomy would serve multiple purposes, including classifying eligible green projects, ensuring capital is allocated effectively, enabling regulatory oversight to reduce misuse, and encouraging private-sector investment in green technologies[21].

- Introduce financial incentives: Vietnam's financial system is predominantly bank-centric, and the capital markets remain underdeveloped, restricting diverse funding avenues. Additionally, existing fiscal incentives for sustainable bond issuance are insufficient to encourage domestic and international investors to participate in the market. This barrier highlights the need for the government to introduce targeted policies to incentivize sustainable bond issuers by means of tax advantages, reduced regulatory fees, and other financial benefits designed to encourage entry to the market. For instance, Singapore introduced the Sustainable Bond Grant Scheme in 2017 and the Green and Sustainability-Linked Loan Grant Scheme in 2021 to lower the barriers to entry for sustainable bond issuers. Malaysia launched the SRI Sukuk and Bond Grant Scheme in 2018 to support sustainable financing.[20] These examples serve as lessons for Vietnam’s policymakers and regulators to adopt attractive financial incentives to drive the demand and supply of sustainable bond market.

- Expand technical capacity and verification systems: Vietnamese financial institutions currently face a significant skills gap in evaluating and managing green bond projects. To address this, building technical capacity through ESG-focused training programs and partnerships with multilateral organizations is essential. External verification, a key component of credibility in green finance markets globally, offers valuable lessons for Vietnam. China’s green finance market provides a compelling example. External reviews are central to its success, with 81% of green bond issuances by volume undergoing independent verification, often aligned with Climate Bonds Initiative standards. The introduction of the Green Bond Standards Committee in 2022 brought additional regulatory guidance, accrediting 18 third-party verifiers to ensure high-quality, consistent assessments[2]. Vietnam can replicate these strategies to scale up independent verification services, enhance market credibility, attract investors, and help align Vietnam’s sustainability efforts with global best practices.

- Raise public and private awareness: A lack of understanding about the benefits of green bonds is slowing market growth in Vietnam. Investor participation in sustainable bonds is narrow, with domestic investors—primarily commercial banks—favoring high-profit ventures over sustainable products. To address this gap, public and corporate education campaigns should highlight how green bonds deliver both economic returns and sustainability benefits through training programs, seminars, media campaigns, and knowledge-sharing platforms. The Global Green Growth Institute (GGGI) and Vietnam's Ministry of Finance have initiated capacity-building programs to support the development of the green bond market[23]. These initiatives include training events aimed at enhancing the knowledge and skills of potential verifiers and key third-party assurance providers in Vietnam's green bond ecosystem. By ensuring stakeholders understand the value and role of green bonds, these efforts will boost demand, expand participation, and accelerate sustainable financial growth in the country.

Accelerating green finance in Vietnam requires a joint effort from the government, financial institutions, and international organizations. However, for corporate executives, sustainable financing is more than just a passing trend—it serves as a strategic pathway to unlock capital, enhance ESG performance, and align with global sustainability goals. By effectively navigating bond issuance, ensuring transparent management of proceeds, and forging partnerships with financial institutions, businesses can drive innovation while contributing directly to Vietnam’s development objectives. The next chapter will delve into this further.

Corporate leaders can accelerate green bond financing by collaborating with financial institutions and strategic partners to develop and fund sustainable projects

Recent green bond issuances by IDI (International Development & Investment Corporation) and Hoa Binh-Xuan Mai Clean Water Limited Liability Company (Hoa Binh-Xuan Mai) serve as prime examples of how corporate leadership, together with the right partnerships, can drive green finance. These cases demonstrate that Vietnamese businesses can take the initiative in aligning projects with sustainability goals while financial institutions and development organizations provide the necessary structuring, verification, and guarantees.

In November 2024, IDI issued 1000BVND in green bonds to finance sustainable aquaculture infrastructure. This marks the first aquaculture-focused green bond in Asia. Vietcombank Securities (VCBS) acted as the advisor and issuance agent, while GuarantCo provided a guarantee to de-risk the investment and attract institutional investors.[24],[25],[26] Not only does the project enhance Vietnam’s seafood industry but it also sets a precedent for future green bond issuances in the agriculture and aquaculture sectors.

Similarly, Hoa Binh-Xuan Mai successfully issued 875.1BVND in 20-year green bonds to fund clean water infrastructure. This issuance was backed by GuarantCo and supported by technical assistance from the Global Green Growth Institute (GGGI).[27],[28] The funds are allocated to expand water supply systems in underserved regions which help to address critical water access challenges while reduce the environmental impact of water distribution.

The impact of these green bond issuances extends beyond the individual projects. IDI’s aquaculture bond aims to modernize seafood production, contributing to improved food security and reduced environmental degradation in Vietnam’s coastal regions. By promoting sustainable practices in aquaculture, the issuance aligns with broader national goals of lowering carbon emissions and enhancing climate resilience in the agriculture sector. Meanwhile, the Hoa Binh-Xuan Mai green bond directly supports clean water initiatives, improving water quality and availability for communities in northern Vietnam. This project is expected to bolster public health, reduce the risk of waterborne diseases, and create a blueprint for future green bonds targeting essential infrastructure projects.

To fully capitalize on the growing green finance market, corporate leaders must take a proactive and strategic approach. Green bond issuances like those by IDI and Hoa Binh-Xuan Mai highlight the importance of aligning business operations with sustainability goals and leveraging partnerships to unlock capital. However, successfully navigating the green bond landscape requires a comprehensive strategy that integrates sustainability into core business practices, builds internal capacity, and fosters innovation. We will outline essential considerations for businesses looking to drive green bond financing and fund sustainable growth below:

- Develop clear sustainability strategies: Corporate leaders must develop clear sustainability strategies that define long-term environmental and social goals and provide a roadmap for achieving them. This involves assessing operations to identify high-impact green initiatives and setting measurable targets, such as reducing carbon emissions or improving resource efficiency. A clear strategy aligns operations with sustainability frameworks, guides project development, and demonstrates commitment to investors and stakeholders. By embedding sustainability into business planning, leaders can seamlessly integrate green bond initiatives, enhancing competitiveness and resilience in an evolving market.

- Collaborate with financial institutions and strategic partners: To accelerate green bond issuance, corporate leaders should actively collaborate with banks, market leaders, and international financial networks. These partnerships offer access to advisory services, risk mitigation tools, and market insights essential for structuring effective green bonds. Financial institutions and regulators can help align bond structures with national goals and international standards, enhancing compliance and investor confidence. Partnering with development finance institutions (DFIs) can also provide technical assistance and guarantees to reduce investment risks. Leveraging these partnerships enables leaders to streamline the issuance process and attract a wider pool of investors.

- Invest in capacity building and expertise: Building internal expertise is crucial for navigating the complexities of green finance. Corporate leaders can establish dedicated sustainability teams, conduct in-house research, or implement cross-departmental training programs. Collaborating with organizations like the International Finance Corporation (IFC) or regional institutes for specialized training is another effective approach. Alternatively, hiring sustainability consultants or creating advisory boards with environmental finance experts can provide valuable guidance. These efforts ensure the company stays ahead of green finance trends, empower teams to identify and execute sustainable projects, and accelerate green bond readiness while fostering innovation.

- Create transparent reporting and impact metrics: Transparency is key to building investor confidence and maintaining the credibility of green bonds. Corporate leaders should adopt robust reporting frameworks aligned with global standards like the Green Bond Principles (GBP), Climate Bonds Initiative (CBI) guidelines, and Global Reporting Initiative (GRI). These frameworks enable regular disclosures on project progress, environmental impact, and fund allocation. Publishing annual or semi-annual reports gives investors a clear view of how proceeds are used and the tangible benefits achieved. Transparent impact metrics not only strengthen investor trust but also enhance access to future financing by showcasing accountability and alignment with sustainability goals.

- Foster innovation in project financing: Corporate leaders can explore options beyond traditional green bonds, such as sustainability-linked bonds (SLBs), social bonds, or hybrid instruments that combine loans with green bonds. These tools offer flexibility, aligning financing terms with sustainability targets or social goals. For instance, SLBs are ideal for companies funding projects where proceeds aren't directly tied to sustainability but set company-wide KPIs for accountability. Diversifying financing structures enables businesses to address a broader range of sustainability challenges while attracting new investors. This strategy maximizes funding potential and enhances the impact of sustainable initiatives, positioning the company as a leader in environmental and social progress.

In conclusion, Vietnam’s sustainable bond market is still in its early stage, but corporate leaders can get ahead by embracing green finance as a growth and competitiveness strategy. By taking action now to develop sustainability-focused plans, partner with financial institutions to issue sustainable bonds, businesses can establish themselves as trailblazers in a rapidly evolving market. Investing in ESG expertise, transparent reporting, and innovative financing will not only attract new capital but also build resilience and boost brand reputation. As Vietnam moves forward with its green transition, companies that lead in sustainable finance will gain a vital edge, shaping the market and driving meaningful economic and environmental change.

Definitions of key terms[1],[3],[22]:

- Green finance refers to funding that promotes environmental goals, including climate resilience, conservation of natural resources and biodiversity, and efforts to prevent and control pollution

- Social finance involves funding directed at addressing or mitigating social issues, aiming to generate positive social impacts, particularly for specific target groups, though not exclusively

- Sustainable finance encompasses both green and social finance, while also factoring in broader aspects such as the long-term economic viability of funded entities and the stability and role of the overall financial system they operate within

- Sustainable bonds cover green bonds, social bonds, sustainability bonds, sustainability-linked bonds, transition bonds, and transition-linked bonds. They may be issued by corporates (banks and other companies), governments, and quasi-government entities (such as councils or municipalities) to finance or refinance projects

- Green bonds are financial instruments where proceeds are allocated to fund environmental or climate-related initiatives

- Social bonds are financial instruments used to finance projects aimed at promoting social welfare and improving outcomes for disadvantaged communities

- Sustainability bonds are debt instruments whose proceeds will be used to support projects that have components of both environmental and socially related projects

- Sustainability-linked bonds are bonds with the coupon rate lined to the firm’s sustainability targets

- Transition bonds are bonds whose proceeds will be used to fund the firm’s shift towards reducing its environmental impact.

- Transition-linked bonds are bonds whose financial or structural characteristics such as coupon rate will change depending on how well the company will achieve its transition goals

References:

[1] Asian Bonds Online (2024) retrieved at https://asianbondsonline.adb.org/data-portal/ on 20 December 2024.

[2] Climate Bonds (2023) retrieved at https://www.climatebonds.net/resources/reports/2023?field_report_type_tid=1315&field_report_language_tid=590 on 25 November 2024.

[3] SSC/IFC/SECO/CBI (2021) retrieved at https://asianbondsonline.adb.org/green-bonds/pdf/How%20to%20Issue%20Guide%20English%20FINAL%20PRINT.pdf on 31 December 2024.

[4] Vietnam Finance (2024) retrieved at https://vietnamfinance.vn/thuc-day-trai-phieu-xanh-chi-uu-dai-thue-la-chua-du-d119849.html on 31 December 2024.

[5] Asian Development Bank Institute (2019). Handbook of Green Finance: Energy Security and Sustainable Development. Springer Singapore. Editors: Jeffrey D. Sachs, Wing Thye Woo, Naoyuki Yoshino, Farhad Taghizadeh-Hesary.

[6] Vietcombank (2024) retrieved at https://www.vietcombank.com.vn/vi-VN/Trang-thong-tin-dien-tu/Articles/2024/11/14/20241114_khung-trai-phieu-xanh on 31 December 2024.

[7] Nhip song kinh te (2024) retrieved at https://nhipsongkinhte.toquoc.vn/vcbs-tu-van-phat-hanh-thanh-cong-1000-ty-dong-trai-phieu-xanh-cho-idi-20241204165119502.htm on 31 December 2024.

[8] The Global Green Growth Institute (2024) retrieved at https://gggi.org/gggi-supports-idi-sao-mais-usd-40-million-green-bond-issuance-boosting-sustainable-finance-in-viet-nams-seafood-industry/ on 31 December 2024.

[9] The Global Green Growth Institute (2024) retrieved at https://gggi.org/green-bonds-driving-clean-water-infrastructure-development-for-hanoi-residents/ on 31 December 2024.

[10] GIZ (2016) retrieved at Green Financial Sector Reform in Vietnam.pdf on 31 December 2024.

[11] World Bank (2024) retrieved at https://www.worldbank.org/en/country/vietnam/overview on 31 December, 2024.

[12] Deutsche Gesellschaft für Internationale Zusammenarbeit (2023) retrieved at https://www.giz.de/en/downloads_els/GIZ%2030%20Years%20EN.pdf?utm_source on 31 December, 2024.

[13] Food and Agriculture Organization of the United Nations (2022) retrieved at https://www.fao.org/faolex/results/details/en/c/LEX-FAOC212027/ on 31 December, 2024.

[14] Vietnam Government Portal (2023) retrieved at https://chinhphu.vn/?pageid=27160&docid=209074 on 31 December, 2024.

[15] The Ministry of Finance (2022) retrieved at https://www.mof.gov.vn/webcenter/portal/ttpltc/pages_r/l/chi-tiet-tin-ttpltc?dDocName=MOFUCM258283 on 31 December, 2024.

[16] Vietnam Securities Review (2024) retrieved at https://tapchichungkhoan.vn/du-lieu-thi-truong/trai-phieu-xanh-gop-phan-nang-cao-chat-luong-hang-hoa-cho-thi-truong-tpdn-t42395.html on 31 December, 2024.

[17] Deutsche Gesellschaft für Internationale Zusammenarbeit (2023) retrieved at https://www.giz.de/en/worldwide/135006.html on 31 December, 2024.

[18] The Ministry of Finance (2023) retrieved at https://www.mof.gov.vn/webcenter/portal/btcen/pages_r/l/newsdetails?dDocName=MOFUCM284656&dID=287083 on 31 December 2024.

[19] The Ministry of Finance (2023) retrieved at https://mof.gov.vn/webcenter/portal/btcvn/pages_r/l/tin-bo-tai-chinh?dDocName=MOFUCM287459 on 31 December 2024.

[20] Climate Bonds Initiative (2022) retrieved at https://www.climatebonds.net/resources/reports/asean-sustainable-finance-state-market-2022 on 31 December 2024.

[21] Ministry of Information and Communications (2024) retrieved at https://tapchinganhang.gov.vn/phat-trien-thi-truong-trai-phieu-doanh-nghiep-xanh-kinh-nghiem-quoc-te-va-khuyen-nghi-chinh-sach-14545.html on 31 December 2024.

[22] ICMA (2020) retrieved at https://www.icmagroup.org/assets/documents/Regulatory/Green-Bonds/Sustainable-Finance-High-Level-Definitions-May-2020-051020.pdf on 31 December 2024.

[23] The Global Green Growth Institute (2021) retrieved at https://gggi.org/training-opens-for-green-bond-verifiers-in-viet-nam/ on 31 December 2024.

[24] GGGI (2024) retrieved at https://gggi.org/gggi-supports-idi-sao-mais-usd-40-million-green-bond-issuance-boosting-sustainable-finance-in-viet-nams-seafood-industry/ on 31 December 2024.

[25] GuarantCo (2024) retrieved at https://guarantco.com/news/guarantco-provides-a-vnd-1000-billion-guarantee-over-green-bonds-issued-by-idi-sao-mai-to-support-vietnams-aquaculture-infrastructure-a-first-in-asia/ on 31 December 2024.

[26] Nhip song kinh te (2024) retrieved at https://nhipsongkinhte.toquoc.vn/vcbs-tu-van-phat-hanh-thanh-cong-1000-ty-dong-trai-phieu-xanh-cho-idi-20241204165119502.htm on 31 December 2024.

Tags

Sustainability, Green economy, Green finance, Sustainable bonds, Sustainable bond market, Green bonds