Dynamic pricing - a little understood tool for boosting growth

26 September 2017 — Dynamic pricing is a powerful, yet underutilized revenue management tool with applicability across industries. Many companies lack understanding of the value of dynamic pricing, or the requirements to implement it.

Problem

Companies fail to utilize the opportunities to maximize their revenue and margin by persisting on fixed-pricing mechanisms, and lacking awareness on alternative pricing solutions.

Why it happens?

In the past, data limitations have restricted the solution applicability to industries where online shopping is a norm. Real-time and automated pricing mechanisms are also avoided due to fear of customer reactions, and limited understanding on the implementation requirements.

Solution

With current technology, many industries could adopt dynamic pricing, especially when products or services are time-based and customers have low price elasticity. To mitigate setup costs and customer reactions, dynamic pricing should be gradually initiated and later adjusted with gained insights.

Download this post (PDF)

Dynamic pricing is a powerful, yet underutilized revenue management tool with applicability across industries. Many companies lack understanding of the value that dynamic pricing can deliver, or the requirements of implementing it. However, recent technology development makes it possible for companies of all sizes and across industries to leverage this powerful tool to drive growth. Here we present potential dynamic pricing applications for different types of businesses, and discuss the requirements of implementation. This article is built on previous Reddal Insights article, which focused on the principles of dynamic pricing.

Impact of dynamic pricing can be cost-effectively captured by even SMEs

Dynamic pricing adjusts prices of products and services continuously in response to the demand and supply conditions in the market. In a previous Reddal Insights article we discussed the basics of dynamic pricing – setting up the objectives, implementation, and the common pitfalls to avoid. Dynamic pricing is a versatile tool that can serve multiple purposes, from growing top line and improving profitability to optimizing inventory levels, and gathering intelligence on customer behavior.

Hospitality, transportation, and professional sports have utilized dynamic pricing extensively for decades. Many industries (property management, cleaning services) also use time-based pricing but are missing the data and analytics driven core of dynamic pricing. The rate of technological development has recently accelerated the applicability and potential of dynamic pricing. Novel, easy-to-use software technology and cloud-based solutions make it feasible for companies of all sizes to adopt dynamic pricing. Companies can now track and forecast how demand for their products and services changes. This is made possible by decreasing computer power costs, demand-tracking sensor technology and digital price tag technologies. Customers’ increasing habit of purchasing products and services online allows data on their demand to become more obtainable.

Many other industries could also benefit from adopting dynamic pricing to manage their revenue more efficiently. In our experience, good understanding of customer behavior and flexibility in the pricing process is critical. Companies might overlook dynamic pricing if it is not a standard practice in their industry, because they are not familiar with the concept or the technical solutions that enable it. There is also a misconception about the effort required to start pricing dynamically.

In industries where dynamic pricing is not yet widely used, decision makers might easily overlook its power. Smaller companies may fear not having the required data and technology infrastructure in place to fully leverage dynamic pricing. However, the required customer data is often easily accessible from a digital sales ledger. Another often expressed concern is whether customers are ready for a differentiating pricing scheme. Dynamic pricing fundamentally is the practice of selling at different prices to different clusters of customers, or at different prices at different demand conditions. As such, it is recommended to consider carefully whether there is a demand risk for consumer backlash to a new pricing mechanism. Transparent communication is critical to ensure customers understand the rationale behind different pricing levels. Customer communications should have a positive connotation, for example putting emphasis on rewarding for early purchases, not penalizing on late actions.

Although one must consider the challenges of dynamic pricing carefully, the benefits are often substantial. With currently available technology, cost of adoption is affordable even for small and medium sized companies. The approach can be refined over time, keeping initial steps simple and costs minimal. As experience and insight is gained along the way, more sophisticated algorithms can be adopted stage-wise. We have experienced iterative step-by-step approach to be most effective regardless of company size, allowing gradual learning. Through the stages, the potential drawbacks from implementing dynamic pricing are also understood and can be mitigated.

To illustrate this, consider a Nordic entertainment company with revenue of 10 million euros. With weekly average of 1000 customer transactions, the company started dynamic pricing via open source software. Many customers had already been making their purchases online, providing data on customer behavior and demand curve without additional data acquisition costs. The total investments dedicated to planning, developing, and implementing dynamic pricing during the first year were 20kEUR, and 10kEUR annually from the second year on. However, the payback from the initiative was substantial, with 10x return in the first year of running the solution and 7% increase in ticket revenue. The setup process took around three months: one month for planning and pre-modelling analysis and two months for building the pricing model, adjusting the parameters and preparing customer communications.

Dynamic pricing has potential in several industries

Many industries could benefit from a dynamic pricing process but have not yet adopted it widely. In this section, we cover four categories: B2B products, B2B services, B2C products, and B2C services. Through these categories that embody different customer dynamics and characteristics, we demonstrate how dynamic pricing can be useful in different contexts.

B2B customers’ purchasing habits are driven significantly by technology, reflected by the increasing presence of two-sided platforms for material sourcing. Consider the fashion industry, where online platforms connect designers or clothing brands with textile suppliers and garment factories. Sourcing is inherently global; hence these platforms help to reduce operational costs. For materials like fabric, demand fluctuates over seasons and fashion trends, giving suppliers good data on market demand, trends, and seasonal fluctuations. These dynamics of time-variant demand provide good conditions for setting up a dynamic pricing process.

Pricing B2B services faces challenges due to their unique characteristics: prices are often negotiated around different factors and salespeople are instrumental in setting the price. Dynamic pricing has opportunities here since customers are ready to pay for value and differentiation in prices is already well-acknowledged. Service companies such as advertising agencies, web hosting, or graphic design can utilize dynamic pricing to support sales personnel during negotiation process. Pricing based on the companies’ resource utilization rate gives the salesperson a real-time assessment of supply-demand balance, and hence guidance for a suitable price level. This can be leveraged to extract additional price for selling marginal capacity when resources are highly utilized, or to improve utilization at a lower price to avoid slack.

Historically, consumer-focused industries such as travel and hospitality have been pioneers in adopting dynamic pricing. Product prices are constantly adjusted based on availability, customer demand and how far in advance customers made reservations. Dynamic pricing is valuable for B2C services companies with limited supply such as car or boat parking services. Demand for these services varies with events in the area, weather condition, or holidays. Different permutation of these variables will influence the demand, while supply hardly adjusts at all. Systematic dynamic pricing allows service providers to maximize their revenues while not setting an arbitrary price level that would otherwise drive customers away. Technically such pricing algorithm takes real-time input from sensor data, and has been already proven to be feasible in some markets. For example, the city of Boston has previously implemented a successful pilot for demand-responsive parking slots.

Pricing differentiation is applicable when businesses must sell a stock of items before a certain deadline, as in the case of perishable products. For dairy products or batteries, prices can be set by taking into consideration the expiration date, with pricing adjusted in real time through algorithms. Currently many grocery stores deal with pricing of perishable products by manual adjustments, tagging a fixed amount of discount for the expiring products. In contrast to automation, manual adjustments are more expensive to implement and less dynamic in price setting. Hence, linking stock and demand data closely to price setting can be a very effective tool to minimize waste.

In consumer product cases, companies who already have web-based sales are most suitable in updating price changes. Otherwise, alternative options for price presentation, such as digital price tag or electronic shelf label, should be considered. Not only the employees but also the customers benefit from the streamlined process created by dynamic pricing and digital price tags: prices are automatically updated and salespeople can devote more time to customer service. Small stores can equip electronic labels to a section of product assortment.

Dynamic pricing is most suitable when the products are time-based and customers have low price elasticity

Dynamic pricing also helps companies become more competitive and adaptive to market changes. Developing an effective dynamic-pricing process begins with a thorough understanding of the business’s specific context and characteristics.

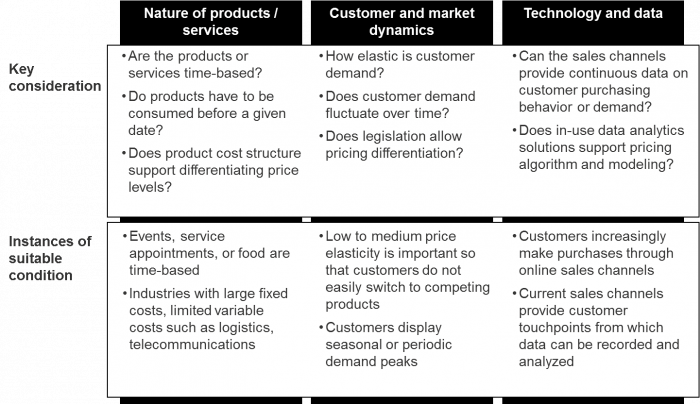

The above-mentioned examples bear similar characteristics that serve as starting conditions for a dynamic pricing approach. Here we provide a synthesized view on the typical attributes that yield a good basis for dynamic pricing. The following framework provides a guideline for an initial self-assessment of dynamic pricing feasibility.

Figure 1. Key considerations for dynamic pricing

The nature of products or services should first be systematically looked through when contemplating dynamic pricing adoption. Products with a time-based limitation or expiration would make a good case for dynamic pricing. A structure of large fixed costs and limited variable costs, such as for logistics services or telecommunications, also provides potential opportunities for implementing a dynamic pricing system. In such cases, capacity maximization would yield increase in revenue without significant increase in costs.

Customer behavior and market dynamics are also critical elements to be understood when assessing the opportunity for dynamic pricing. The method is most applicable when there is some level of fluctuation in demand. If data indicates that customers have previously displayed seasonal or periodic variation in demand, pricing differentiation is a rational decision. Low to medium price elasticity is ideal so that customers do not instantly refrain from purchasing at a higher price. Naturally, legislative environment needs to be considered to ensure price differentiation can be initiated in a market.

Dynamic pricing can be refined, keeping initial steps simple and costs minimal

Implementing dynamic pricing should always start with analysis on demand fluctuations and customer behavior to assess the potential for solution. Meanwhile, thorough understanding on required system changes provides estimates on implementation time and cost. If the business case looks positive after these assessments, focus should be on developing a communication plan towards customers to mitigate potential negative reactions. Piloting the new pricing process for certain geography or product should then be utilized to validate the assumptions. Full launch and continuous iteration follows from that - once you receive more understanding on demand curve and customer preferences, the pricing parameters should be continuously calibrated to extract more value to your business.

***

References

Herbon, A., & Khmelnitsky, E. (2017): Optimal dynamic pricing and ordering of a perishable product under additive effects of price and time on demand. Retrieved from http://www.sciencedirect.com/science/article/pii/S0377221716310670

Tags

Dynamic pricing, Pricing strategy, Revenue management, Sales growth, Profitability, Data driven, Analytics, Article