Capturing the neglected consumption growth potential in China

29 June 2020 — Based on Reddal’s work in China over the past few years and recent insights, this article shares different realities around Chinese consumers and shares potential actions to tap into uncovered consumer potential in China.

Download this post (PDF)

Idea in brief

Chinese consumers have demonstrated to the domestic market as well as to the world their powerful and transformative force. Domestic consumption is recognized as a new growth driver of the country’s economy on top of traditional ones, such as investment and exports. China has ended its COVID-19 lockdown and the economy is restarting gradually. When export activities stall due to a pandemic, consumers come under the spotlight. Foreign companies have typically focused on tier-1 and perhaps tier-2 cities. However, neglected consumers in tier-3 and lower tier cities will drive the next wave of consumption growth. This article gives a detailed profiling on Chinese consumers, especially ones in tier-3 and lower cities, and share some insights on capturing value from their growing retail consumption.

The multifaceted reality of Chinese consumers

Many factors/experts have contributed to a comprehensive coverage on China’s large population and its expanding middle class. But few have drawn a detailed view on the composition of Chinese consumers.

The population of China has grown from 542 million in 1949 to 1.4 billion in 2019, which accounts for one-fifth of the world’s population. During the past decade, China has experienced a rapid urbanization process. With almost 200 million people moving into cities, the share of urban population has increased 11% (Figure 1)[1].

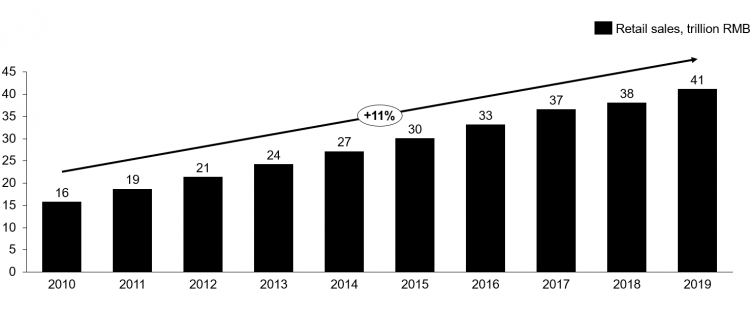

Meanwhile, the country’s GDP has grown steadily since the past reform and opening up in 1978, whereby China became the 2nd largest economy in the world. In 2019, the Chinese economy grew by 6.1% [2] amid a trade dispute with the US. Growing economy leads to increased purchasing power. Retail sales have grown more than 1300 times since 1952 to 41 trillion RMB (about 5.8 trillion USD, Figure 2) [3]. Chinese consumers have unleashed their stunning purchasing power. In 2019, the Single’s Day—a online shopping festival organized by internet giant Alibaba—has seen a record of 1 bUSD in sales within just 85 seconds, and almost 30.8 bUSD in sales during the 24-hour annual sales event[4]. Total sales went up by 7% compared to 2018. It has become the world’s largest online sales event with total sales exceeding those of Black Friday and Cyber Monday combined.

Country level data portrays China as a land of emerging opportunities. However, it must be acknowledged that China is still a developing country with an upper-middle-income economy. In 2019, annual disposable income per capita in China was 30,733 RMB (about 43,11 USD) and median was 26,523 RMB (about 37,21 USD), barely passing the upper middle-income threshold defined by the World Bank [5]. Income distribution (Figure 3) reveals that there are about 1.1 billion people (excluding the population from age 0 to 14) earning less than 5,000 RMB (about 700 USD) per month [6].

There is also a stunning unbalance between urban and rural areas, as well as between the provinces. In 2019, annual disposable income per capita in urban areas was 42,359 RMB (about 5,942 USD), which is 164% higher than 16,021 RMB (about 2,247 USD) in rural areas (Figure 4) [7]. The urban-rural income gap is significant but is narrowing down as income in rural areas grow higher than that in urban areas.

Between/among the 31 provinces, development level varies significantly. While Beijing and Shanghai step into the high-income club, there are 20 provinces still in the lower-middle income classification (Figure 5) [8]. The economy imbalance created the world’s most extensive internal migration. In 2015, China had a total of 277 million migrant workers [9], who work outside of their home province. Migrant workers in China are not only rural workers, but also people who keep household registrations in their home province while working elsewhere.

One key focus area of the Chinese government is to narrow the income gap between urban and rural areas, as well as between different provinces. As a result, rural areas and provinces with low disposable income levels see higher growth rates. This task became even more challenging when the economy was hit by the pandemic. During Q1 2020, average disposable income per capita dropped by 3.9% in urban areas and 4.7% in rural areas. Unemployment rate is soaring to 6.2% [10]. Chinese government pledges the largest stimulus package amid the pandemic, promising a package of 2 trillion RMB (about 280 billion USD) to keep the livelihood of the economy and support SMEs. Additionally, a 4 trillion RMB (about 559 billion USD) cost-cutting has been pledged with measures such as tax exemptions, lower bank interest rates, waived social welfare contribution, and reduced prices for utilities.

In contrast to the 4 trillion RMB stimulus package China introduced in response to the global financial crisis back in 2008, which focused on massive infrastructure investments, the Chinese government aims to maintain a steady flow of money into the economy, especially in retail sales. For example, the government is encouraging small business owners to set up street vending stalls to address issues of unemployment and economic downturn. During a press conference, Chinese Premier Li Keqiang praised the example of Chengdu, which generated 100 000 jobs overnight by setting up 36 000 street vending units [11].

Submerge to lower tier markets to ride the next wave of consumption growth

The differences and gaps between provinces and cities drive more diversified consumption habits. Foreign brands have typically focused on consumers in tier-1 and perhaps tier-2 cities, which accounts for about 400 million of the Chinese population in those cities, consumers are mature, and growth is slowing down. In this challenging situation, the stimulus package eyes on lower tier cities that will drive the next wave of consumption growth. Consumers in tier-3 and tier-4 cities are brand driven, while lower markets are still in mass consumption stage.

Supported by the government’s stimulus package, the consumption potential of tier-3 and lower tier cities will be unleashed. Companies that aim to capture this opportunity need to submerge their marketing efforts into lower tier markets and adjust their brand portfolio to embrace the long tail effect created by diverse consumption habits.

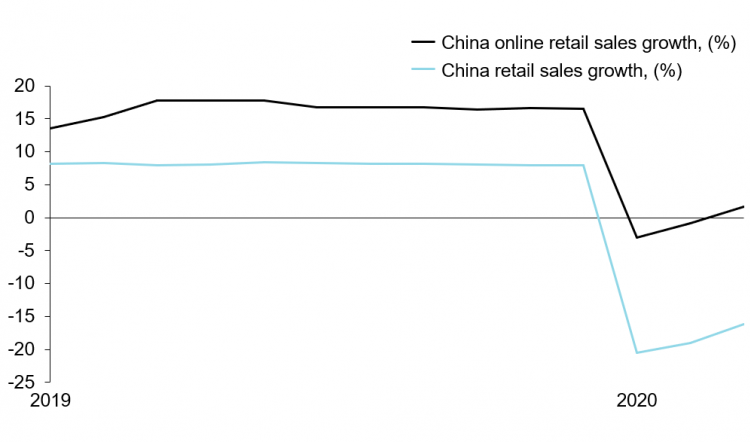

“Xiachen”, a word that literally means to sink or to go down, is going viral in China as a marketing term. It means that companies need to expand their marketing efforts into lower tier markets. “Xiachen” is becoming a popular term in China as consumers in lower tier cities have demonstrated their potential to drive the next wave of consumption growth. During Alibaba’s Single’s Day shopping festival in 2019, consumers in lower tier cities spent more than ones in top tier cities. As rising incomes lead to an upgrade in consumption, consumers in lower tier cities are looking for higher-quality goods, yet at reasonable prices. These consumers spend more time online and are used to e-commerce, which is less impacted by the COVID-19 (Figure 6) [12].

Social media platforms and short-video apps, combined with e-commerce, provide a new channel for companies to maximize its reach to consumers. Streamers have demonstrated an astonishing level of influence. With more than 40 million followers on TikTok, Austin Li, the platform’s most famous streamer, managed to close deals worth 1 billion RMB (about 140 million USD) during a 6-hour livestream show viewed by more than 36 million people [13]. Li has proven that he can turn viewers on entertainment short-video apps into buyers. According to the South China Morning Post, Taobao’s livestreaming service has a jaw dropping conversion rate of 32%[14]. Live streaming is becoming a mainstream e-commerce model in China. Consumers in lower tier cities have a relatively slow-paced lifestyle with more time for leisure, as well as an increasing purchasing power. However, they have a limited choice of brands and products. When consumers cannot go to brands, brands must show them the world. Live streaming is becoming a key information channel for consumers in lower tier cities, especially young ones who are mobile-first, digital-loving hi-tech natives. Chinese brands have been quick, leveraging fast development of mobile internet, to transition their sales to online livestream and e-commerce platforms such as Taobao and TikTok.

The large number of diverse consumers in lower tier markets require more options. While utilizing emerging channels such as livestreaming to reach those consumers, companies need to embrace the long tail to capture the potential. Yes, this sounds like a counterproductive approach as companies need to shift their focuses from few hit products to more niche and diverse markets. However, when companies combine the total revenue from each market backed by 1 billion consumers, it becomes a lucrative option (Figure 7) [15].

Invest for a successful future

The consumer group and market in lower tier cities are fairly new to some international brands. It will take time and effort to fully understand consumer preferences and behavior in this market, to adapt to new channels such as live streaming for reaching the consumers, and to adjust their brand portfolio to capture value. However, companies, who aim for long-term success in China, should form a strategy for tapping into markets in lower tier cities with strong determination and significant resources.

References

[1] [2] [3] [5] [6] [7] [8] [10] [12] [15] National Bureau of Statistics of China

[4] CNBC (2019) Alibaba breaks Singles Day record with more than $38 billion in sales, https://www.cnbc.com/2019/11/11/alibaba-singles-day-2019-record-sales-on-biggest-shopping-day.html

[9] China Labour Bulletin (2020) Migrant workers and their children, https://www.clb.org.hk/content/migrant-workers-and-their-children

[11] The State Council The People’s Republic of China (2020) Premier Li Keqiang Meets the Press: Full Transcript of Questions and Answers, http://english.www.gov.cn/premier/news/202005/29/content_WS5ed058d2c6d0b3f0e9498f21.html

[13] South China Morning Post (2020) Who is millionaire Li Jiaqi, China’s ‘Lipstick King’ who raised more than US$145 million in sales on Singles’ Day?, https://www.scmp.com/magazines/style/news-trends/article/3074253/who-millionaire-li-jiaqi-chinas-lipstick-king-who

[15] Tencent China Technology Insights (2018) The Pulse of Live Streaming in China, Retrieved from http://mat1.gtimg.com/chinatechinsights/file/20160926/The_pulse_of_live_streaming_in_China.pdf

Tags

China, Consumer, Brand, Chinese consumer market, Market potential, Consumption growth, Brand portfolio, Customer targeting